I’m so excited to be learning a new language with Babbel–last time I took a language course was some beginner Spanish in CEGEP! I chose Italian as I’ve been pretty wistful lately of my trips there to Rome, Parma, Milan and Florence, and it feels good to be preparing for future travels.

There are 14 languages on Babbel to choose from, and it provides conversational practice. The classes are presented in a fun way, so it feels playful! They’ve also Babbel Live, Podcasts, Games, Culture Bites, Short Stories and Videos–a ton of resources to enrich your learning experience!

For one lucky Health & Swellness follower, I’m giving away a year-long subscription to Babbel. You can enter via my Instagram post, and for five extra entries, just comment on this blog post about which language you’d like to learn!

Giveaway ends 11:59PM, March 22, 2022 and is open to Canadian residents. Winner will be announced on my IG Stories on March 23rd.

Buona fortuna! Look, I’m speaking Italian already!

March 16, 2022

I reached only one of the goals I’d set for 2020. And I’m totally fine with that. It was a year when doing anything took what felt like 100 times more effort so I’m really proud of having read 18 books when I set out to read a dozen. For the first few months I was ahead of my goal, and then when lockdown became stricter and I found it hard to concentrate on anything, I fell behind. But eventually I worked on cracking open a book more often and it was such a joy to reignite my love of reading, a pastime I’ve been passionate about since I was a kid but fell out of the routine for almost a decade.

My other goals? Well, I barely got started. I had planned to incorporate more cross-training into my routine, and aimed to do one workout a week that was not running. Instead, other than a few workouts before the pandemic (and a few virtual dance classes during lockdown), I focused solely on running (but at least I ran more than ever, completing the Great Virtual Race Across Tennessee, and then ran and walked back across Tennessee). Running is what I know, what I can incorporate into my life without a ton of thought, it’s really just easier for me to wrap my head around even though I know in reality I can easily roll out my yoga mat and find a workout online for a yoga session, for one.

And my other goals to eat more veggies and learn how to use my camera? Well, my diet was all over the place last year (I craved comfort foods and nostalgic eats big time, plus I had a hard time finding time to cook so that impacted how I ate as well), and I simply didn’t have the energy to pick up my camera and take an online course.

And while I don’t set travel goals per se (although I did wish last year to go to Thailand and that came true in December, I’m convinced I manifested it!), because of the pandemic, my travel was downsized significantly last year. I went on a total of six trips; four by flight (Vail, Gimli, Jerusalem and Tel Aviv, and a cruise out of Miami) and two local road trips (to Prince Edward County and a camping trip just north of Toronto at Oastler Lake).

Anyhow, for this year, I just read this New York Times article about making 2021 goals small and gentle. And that really resonated with me. We don’t need to feel bad about not accomplishing a ton right now, living through this crazy time we are all just trying to survive. And they’ll be focused on setting a routine. I already started with including a few things to improve my mornings, and those small things bring a sense of relief in this harsh reality we are living in. Yes, the simple but delicious foamy latte I drink in the morning brings me so much more than just a delicious cup of coffee; there’s a sense of feeling able to take a deep breath and relax even for just a few minutes that comes with this ritual. I think I maybe especially appreciate it since my life has for so many years entirely lacked routine, what with juggling freelance and travel.

So my goals for 2021 will be small:

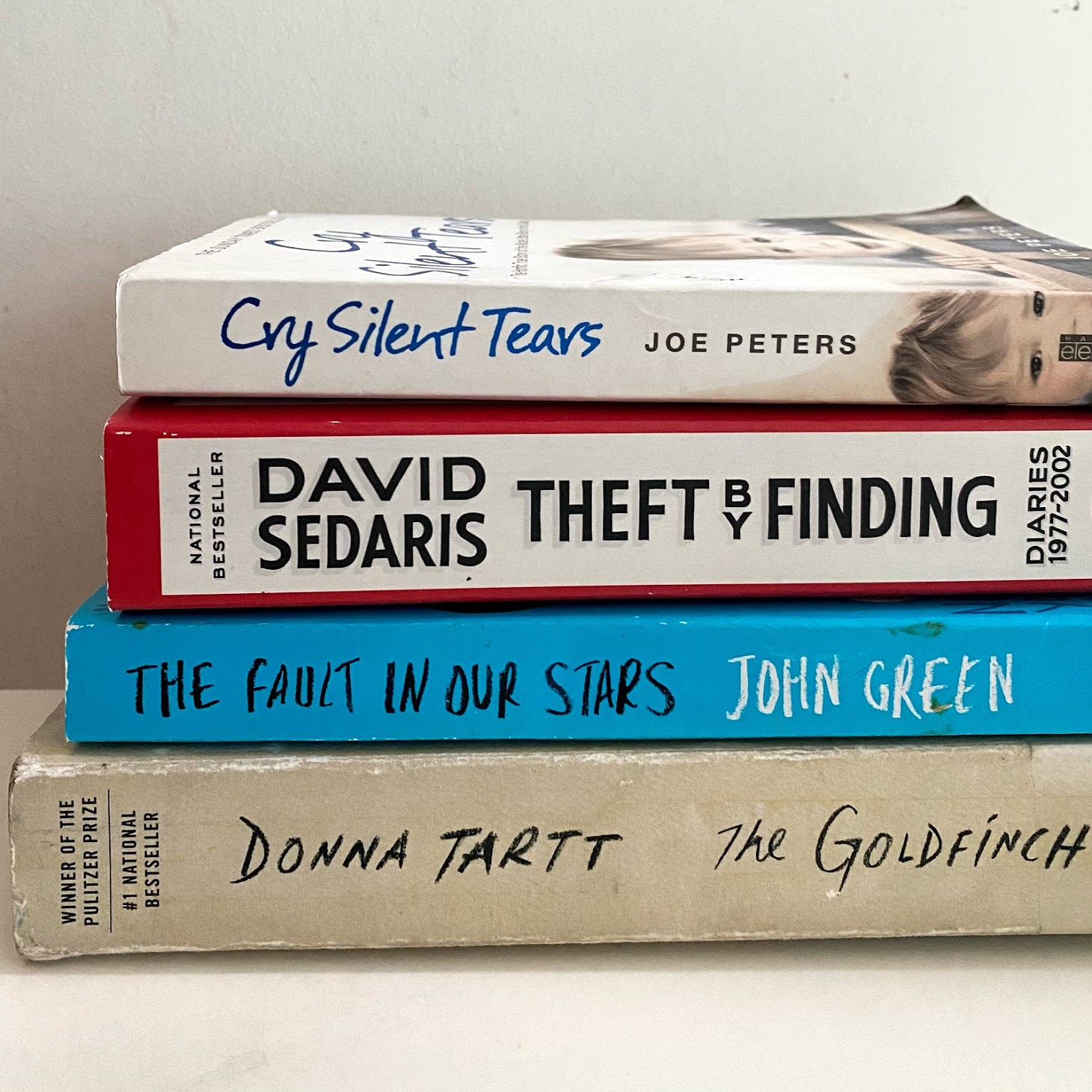

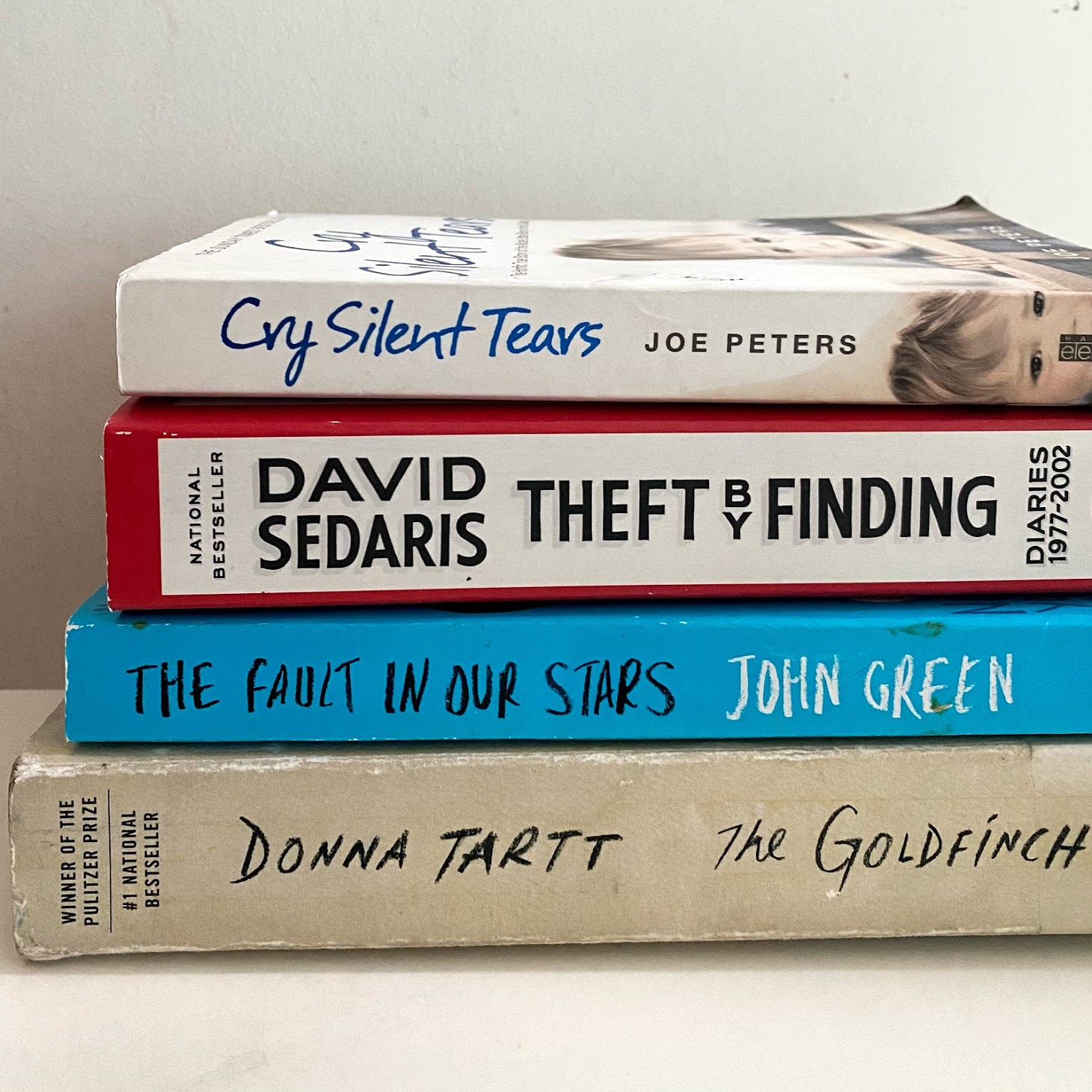

I will read 15 books—and will do so by reading at least 10 pages a day. I’m building on the one goal I achieved! I tend to go days without reading and then read a ton. But this year I will work on reading just a little each day as part of my routine. I’m thinking at bedtime (although I tend to fall asleep pretty darn quickly once I hit the sack!). I know I read more than 15 books last year, but I think that was largely because I read about four of them while on a cruise for a week. Above are some of the books on my shelf to read this year, plus I’ve got several on hold at the library.

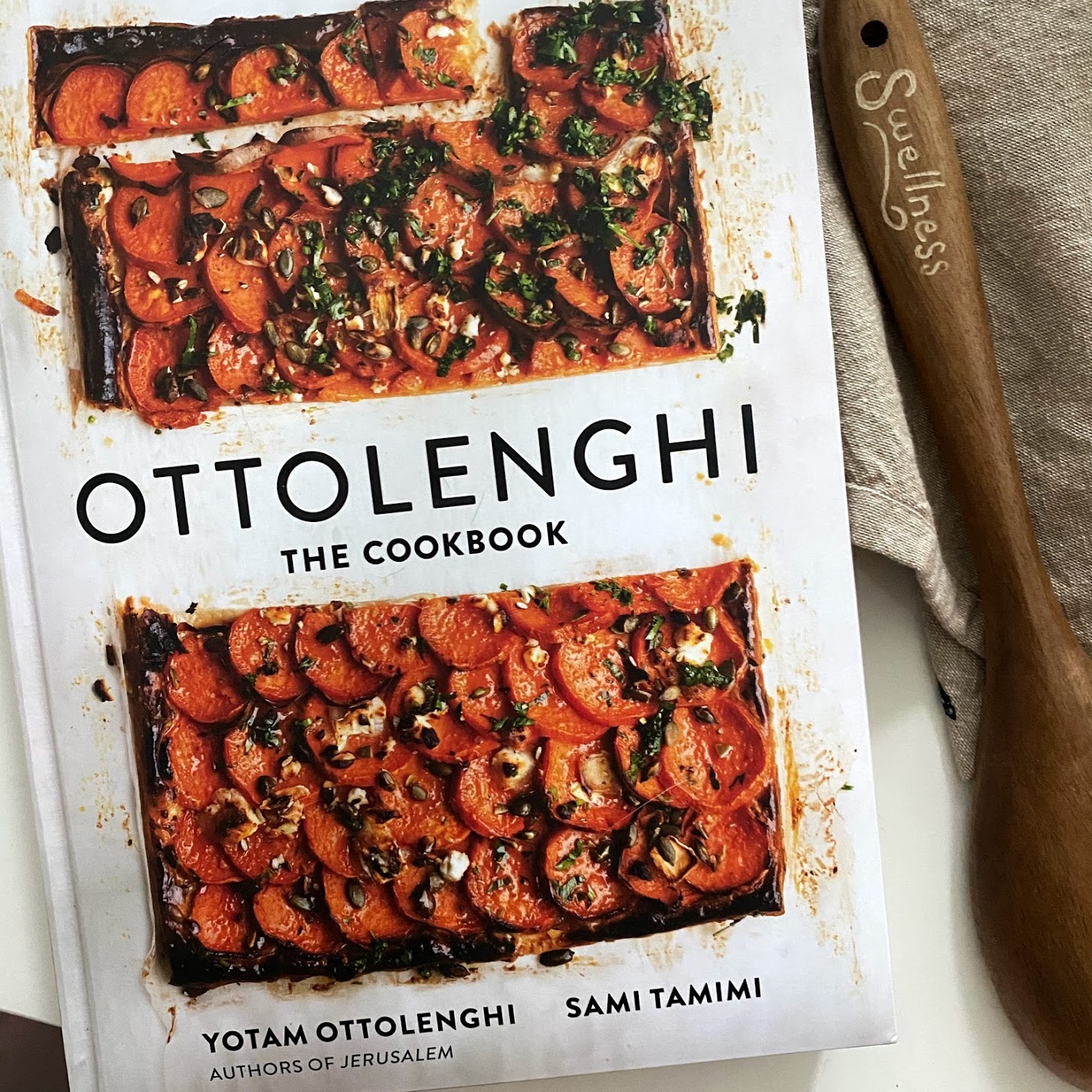

I will make one meatless dish a week. I actually think I ate less veggies last year than ever. I tend to eat more of my veggies as part of my main, but there are loads of easy ways to enjoy vegetables as a side (sauteed green beans or roasted Brussels sprouts are so incredibly simple), so this will be something I can make a habit out of, and it’ll give me a push to look for delicious main dishes that make veggies and meat alternatives the star. Maybe I’ll finally try to make some dishes from this Ottolenghi cookbook; I’ve had it for years and yet have never cooked from it.

I will develop a gratitude habit. I like this idea of building off of the good habits you established last year as mentioned in this New York Times article. It also outlines why reflecting on the past year might seem like a bad idea but that it’s good for you (which I learned when I looked back at 2020). And the first suggestion in the article is to develop a gratitude habit. I have the Five Minute Journal, and haven’t been successful in writing in it daily since I’m often in a rush to get out the door in the morning, so instead as I make and enjoy my morning coffee, I will think of one thing I am thankful for, and take it one step further when it makes sense (say if I’m grateful for the delicious meal I’m picking up that day, then I’ll tip more than usual, for example, or I’ll text that friend I’m grateful for having in my life, both are ideas from that NYT article). This is all something I definitely did more of in 2020, but it was not part of an established routine. The one way I do express gratitude daily already? I do hug Billie Jean and Mya all the time and tell them I love them; I am grateful for them every damn day for the joy they bring me.

Have you set any goals or intentions for the year?

January 3, 2021

When I started the Great Virtual Race Across Tennessee, I fully intended on using the full four months (the race is from May 1st until August 31st) because anything more than the 8.5k daily (or approximately 60k per week) sounded very close to impossible.

I started week 1 with this schedule in mind. I’d just run nearly every day in April to complete 200k and I was kind of regretting having jumped right into a race that would have me running nearly daily all summer. So I’d run 8.5k one day, but the next if I was tired I ran 6k, figuring I’d make up the distance with a longer run on a day with nice weather later in the week. I was very conscious of not falling behind on distance because it could quickly add up and become impossible to complete the race in time.

Then came week 2. And logging my miles into the GVRAT system, I saw where I stood amongst the 19,000 other runners, and well, that competitive side kicked in. I regularly upped my mileage, and now my usual run is 15k, and I’ve taken no days off. Taking a rest day usually means running 10k at a pace that feels easy.

And my goal for the month of May has changed over these past three weeks as well. I initially planned on 250 kilometres; then when I realized the race is actually 1021.68 kilometres (because that’s the actual distance across Tennessee) I added on the extra 22k to May, making my goal 272k. But then with my increased mileage, I realized I’d easily reach that, and I upped it to 300k, then 322k.

So this photo, which I took about a week and a half ago, was intended as a photo for reaching my goal at the end of the month. Except I’ve just reached 322k today, May 24. As for this upcoming last week in May, I’m going to stick to roughly the distances I’ve been logging daily, depending on how my body feels. Today and last Sunday, I can tell my legs need some rest after the 21k I’ve logged two Saturdays in a row.

The race has become a really welcome distraction in my life during the coronavirus pandemic, and my overall goal for the race is now to complete the 1,021.68 kilometres as soon as I can, within reason. I’m wary of injuring myself (this is more mileage I’ve ever run in fixed period of time, and run streaking is also something I haven’t done much of, and knock on wood, I’ve never had a running injury before and I don’t care to have my first injury now).

I’ll recap May at the end of the month, but right now I’ll continue my routine (which besides running, sometimes multiple times a day, translates to so much showering and running-gear laundry!).

May 24, 2020